Improvement in Quality of Education With LED Display in India

February 18, 2020

How Outdoor LED Video Wall can Change Billboard Advertising in India

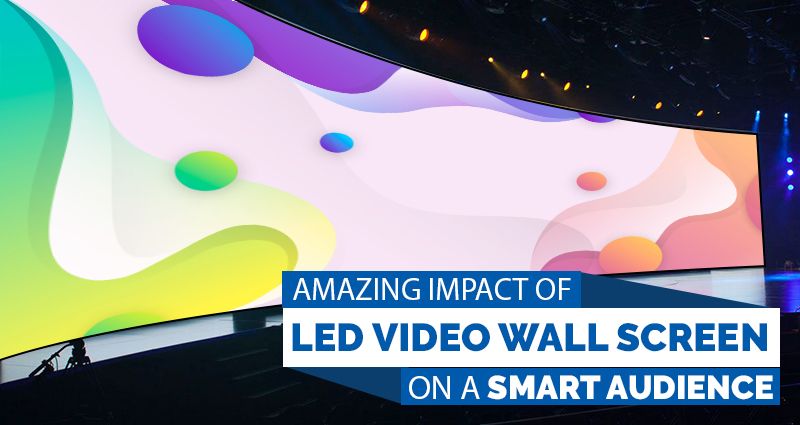

March 6, 2020Use of LED video wall in India can make a remarkable difference in audience response to advertisements. Compared to a static display board mounted with a printed flex screen, 70% more people are likely to get attracted to high quality moving ad on dynamic digital signage. A video wall can evoke a lot more excitement from the audience if it has artificial intelligence (AI) functionality that allows it to display precise communication. The face-reading ability of AI can recognize individuals and their preferences and thereafter display ads or videos that surprise them pleasantly and often induce them to make an impulsive purchase decision. This is expensive and will take some time before it becomes popular.

LED video wall screen in traffic intersection points

In large format display advertising, an LED video wall is designed to achieve a different level of impact on the audience. For viewers who see the spectacular video display unit spanning across the length and breadth of an entire wall, this surely will leave a lasting impact on them. In any traffic intersection point across the major cities of India, the mileage that a brand can get from such a video wall is enormous. The traffic intersection points of urban India are some of the best locations for digital billboards offering a captive audience.

Major advantage offered by digital signage

The option of displaying multiple static ads as well as videos on a single digital screen with the scope of scaling up to multiple screens across multiple locations is another massive advantage offered by an LED video wall in India. This entire operation can be managed remotely with the help of a highly advanced content management system (CMS) software. Displaying new ads or videos or making changes on them can be done in real time. This allows an out of home (OOH) company to earn many times more revenue from multiple advertisers.

Possibilities of growth in the Indian market

The Indian LED video wall screen market offers tremendous scope of growth as digital signage accounts for less than 5% of the large format display market in India. Over 95% of this market is monopolized by static polyvinyl chloride (PVC) flex signage screens that are mounted on most OOH display boards. The Indian market is maturing gradually and it is expected that the pace of change will pick up with the development of smart cities, a major government initiative. However, India needs to expand capacity in local manufacturing of digital signage hardware and software to reduce import dependence and bring down prices.